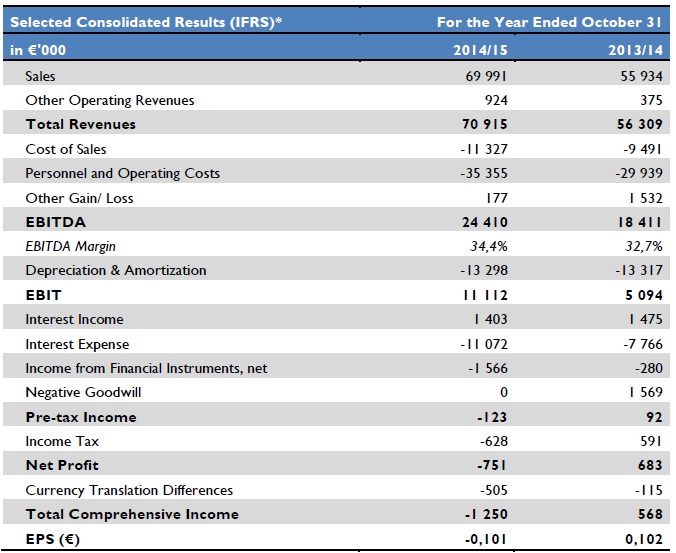

TMR, a regional leader in the operation of mountain resorts and in the provision of tourism

services, today released annual results for the financial year 2014/15 – the period from 1

November 2014 to 31 October 2015. Consolidated revenues of TMR grew 25.9% to EUR

70.9 mil., whereas operating profit EBITDA improved 32.6% to 24.4 mil. EUR.

“TMR had a great year. The winter season 2014/15 was a success; thanks to abundance of

snowfall, the season prolonged till May, and weather favorable for snowmaking especially at

the beginning of the winter, we managed to grow in the number of our visitors to our

mountain resorts. All our segments benefited from the surge of guests. During peak periods of

New Year’s and the Golden week we managed to fill our hotels to the limit despite a decline

in Russian-speaking clients. The summer season continued the positive trend of the winter

with plentiful marketing events and relatively warm weather, favorable for outdoor

activities”, Bohuš Hlavatý, TMR’s CEO and Chairman of the Board of Directors, commented

on the results.

We recorded growth in the number of skier days in the Tatra resorts (+17.7%) and Tatralandia

(+9.4%) in the winter and summer season. The growing visit rate and higher visitor spending

were the key indicators of the double digit percentage revenue growth. For the first time the

results included the results of the Polish resort Szczyrkowski Ośrodek Narciarski S.A. (SON)

and Silesian Amusement Park, since its take-over of operations in May 2015. The total

number of visitors to Mountain Resorts was 1.9 mil. and 777 thous. came to Leisure Parks.

Moreover, the long-lasting impact of the massive investment projects into development of the

Tatra resorts and hotels in prior periods with the total expenditure of EUR 200 mil. till 2014

was reflected in the Group’s results also in the last year and justified an increase of ski pass

prices. Besides an increase in the average revenue per visitor in the resorts (+12.9%), visitors

on average were spending more also on ancillary services such as Dining (+16.7%) and

Sports Services and Stores (+27.5%), so these segments’ share in total revenues grew again.

The decrease of net profit to a loss of EUR -751 thous. was caused mainly by interest

expense, incurred for loans and bonds issued.

Detailed results by segments:

Mountain and Leisure

Thanks to a favorable summer weather and a long winter, rich on snowfall and freezing

temperatures, the main segment of Mountains and Leisure that includes subsegments

Mountain Resorts (Jasná Nízke Tatry, Vysoké Tatry, SON), Leisure Parks (Tatralandia,

Silesian Amusement Park), Dining, and Sports Services and Stores, recorded a year-over-year

28.8% revenue growth to the total of EUR 53.0 mil. and a 22.2% growth like-for-like.

EBITDA increased year-over-year 41.9% to EUR 19.7 mil. and 41.6% like-for-like, which

resulted in operating profitability measured by EBITDA margin of 37.2%.

Mountain Resorts

In the subsegment of Mountain Resorts revenues increased 27.9% to EUR 30.1 mil. and

21.3% without the impact of SON. Mountain Resorts’ EBITDA improved by 58.2% to EUR

12.6 mil. and by 55.1% excluding SON. The successful winter and summer season 2014/15

pulled in a higher number of resort visitors, whose spending were higher on average also due

to a ski pass prices increase on average by 2 euros (1-day tickets). The higher ski pass prices

were justified by the massive capital investments from prior periods. Online ski pass sales via

the GOPASS program increased year-over-year by 194% in the number of sold skier days.

Leisure Parks

The Leisure Parks subsegment achieved a revenue growth of 20.0% to EUR 9.2 mil. on the

like-for-like basis, excluding the impact of Silesian Amusement Park, revenues jumped 4.9%.

Besides the positive impact of Silesian Amusement Park (75% share) on revenues, the

revenue growth was achieved by an increase of the visit rate in Tatralandia, whereas the

average revenue per visitor remained unchanged year-over-year. EBITDA improved by 3.2%

to EUR 4.0 mil. and by 8.3% excluding Silesian Amusement Park.

Dining

The subsegment’s revenues reached EUR 10.8 mil., a 34.6% increase. EBITDA improved

43.1% to EUR 2.4 mil. Success of this subsegment partly depends on the success of the

resorts, since it relates to ancillary services in the mountain resorts. Higher visit rate in the

resorts, higher average spending per visitor (+16.7%), as well as numerous marketing events

during the year contributed to the positive subsegment’s results.

Sports Services and Stores

Revenues of sports stores, ski schools, rentals, and equipment service in Mountain Resorts

under the Tatry Motion brand and revenues of stores in Aquapark Tatralandia are linked to the

visit rate of Mountain Resorts, and thus, they increased as well, to EUR 3.6 mil. (+47.0%).

The performance indicator, EBITDA, improved 90.1% to EUR 737 thous.

Hotels

The second core segment of the Group is the hotel segment, revenues of which reached EUR

16.8 mil. (+15.3%). Besides the growth in average occupancy by 3.6 percentage points and

the average daily rate per room of the hotel portfolio higher by 2.1%, the increased Hotels’

revenues were achieved also by synergies with Mountain Resorts and Tatralandia, effective

marketing, sales, and focus on loyal clients. Maximum occupancy especially during peak

periods, such as around New Year’s and Golden week, and an overall longer winter season

than the year before, also contributed to the results. EBITDA increased 35.6% to EUR 4.5

mil., resulting in EBITDA margin of 26.8%.

Real Estate

The revenues of the Real Estate projects for the past year come from lease of hotel facilities

Hotel Ski & Fun, Hotel Liptov, Kosodrevina Lodge and Hotel Slovakia to third parties and

from sale of recreational real estate, last year from sale of Holiday Village Tatralandia

bungalows. This segment’s revenues reached EUR 1.2 mil. (+85.7%) and EBITDA of EUR

259 thous. (+120.0%).

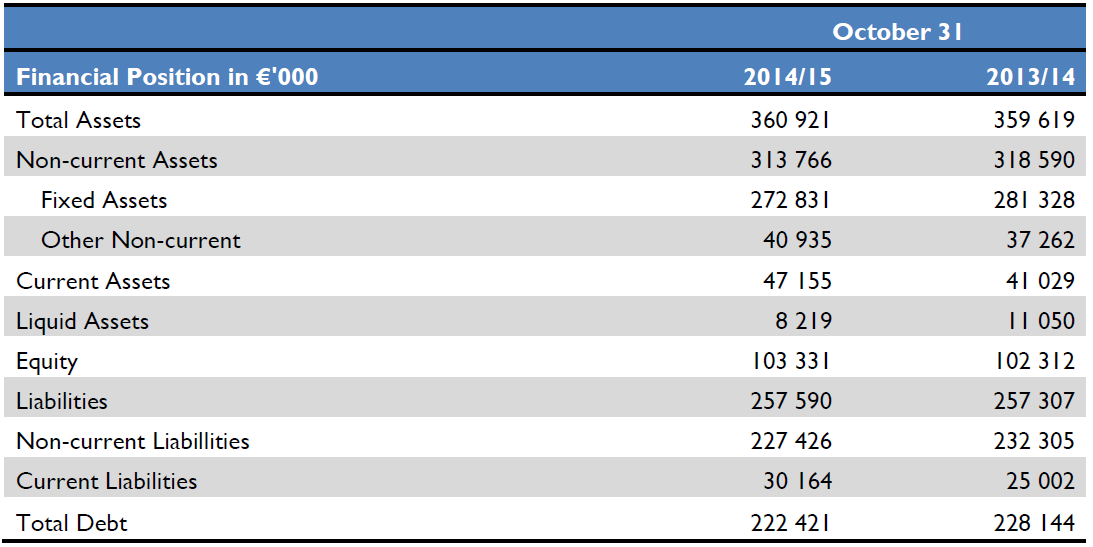

Financial position

The book value of total assets as of the end of the period totaled to EUR 360.9 mil. (359.6).

Non-current assets lowered to EUR 313.8 mil. (318.9) especially due to depreciation of fixed

assets. The book value of equity amounted to EUR 103.3 mil. (102.3). The Group’s total level

of debt reached EUR 222.4 mil. (228.1). Out of that issued bonds totaled EUR 184.5 mil.

Bank loans of the Group as of the end of the period were valued at EUR 37.9 mil.

Outlook

Management expects continuing positive effects stemming from capital investments of prior

periods totaling EUR 206 mil. with impact on the next financial year and following periods, in

terms of increasing the visit rate, client spending in the resorts, and growing occupancy in the

hotels, especially in the off-season. Following the lasting trend of demand for complementary

services (described in Market Analysis and Trends), Management expects further growth in

the subsegments of Dining and Sports Services & Stores similar to the previous year. All

these factors should generate organic growth in the Group revenues and operating

profitability. In the short term Management will be focusing on inter-segment synergies,

quality management, on increasing the quality of services provided and quality of Human

Resources, and on active sales strategy also through the GOPASS program. In the 2015/16

winter season TMR will introduce a new mobile app GOPASS, which will enable easier

online shopping for ski passes, even right at cableway entry gates. Through this additional

sales channel management expects to grow in e-shop sales. As for significant events, after 32

years the Jasná resort will again host the World Cup in Alpine Skiing, which should boost the

popularity of the resort and attract new clients. In the following periods management plans to

continue in the projects of modernization of the Polish SON resort and Silesian Amusement

Park, which are expected to contribute to sales growth by increasing the visit rate and client

spending.

TMR’s Annual Report 2014/15 is available since 29 February 2016 on www.tmr.sk.

_________________________________________________________________________________

Tatry mountain resorts, a.s. (TMR) is the leader in tourism in Central and Eastern Europe; it owns and operates attractive mountain resorts

and hotels. In the Low Tatras TMR owns and operates the resort Jasná Nízke Tatry and hotels Wellness hotel Grand Jasná, Boutique Hotel

Tri Studničky, Chalets Jasná De Luxe, Hotel Srdiečko, and Hotel Rotunda. TMR is also the owner of Aquapark Tatralandia, the largest

Slovak aquapark with year-round operation, which besides water entertainment includes Tropical Paradise, a special tropical indoor hall with

sea water, as well as Fun Park, and accommodation in bungalows and apartments of Holiday Village Tatralandia. In the High Tat ras TMR

owns and operates the resort Vysoké Tatry with mountain areas of Tatranská Lomnica, Starý Smokovec, and Štrbské Pleso, which TMR comanages.

In the High Tatras TMR also owns hotels Grandhotel Praha Tatranská Lomnica, Grandhotel Starý Smokovec, and Hotel FIS

Štrbské Pleso. TMR also owns a 19% share in Melida, a.s., which leases and operates the resort Špindlerův Mlýn in the Czech Republic. In

Poland TMR owns a 97% share in the mountain resort Szczyrkowski Ośrodek Narciarski S.A. (SON) and a 75% share in a company that

owns and operates Silesian Amusement Park (Śląskie Wesołe Miasteczko). TMR also owns and leases hotels Slovakia, Kosodrevina, Liptov

and Ski&Fun Záhradky a Bungalovy to third parties. By the end of 2015 EUR 206 mil. had been invested into development and

modernisation of TMR’s resorts. TMR shares are traded on three European stock exchanges – in Bratislava, Prague, and Warsaw.